January Sees 18-Month High for Manufacturing Output Growth

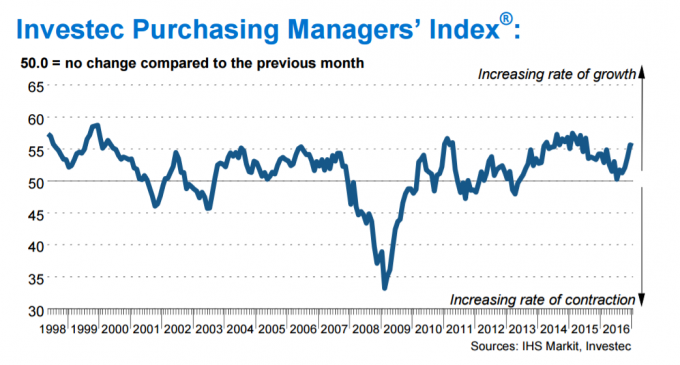

The Irish manufacturing sector remained in growth territory during the opening month of 2017, with both output and new orders increasing at sharper rates, according to the seasonally adjusted Investec Purchasing Managers’ Index (PMI) – an indicator designed to provide a single-figure measure of the health of the manufacturing industry, released on Wednesday.

The survey showed that firms remained strongly optimistic that output would increase further over the coming year, with positive sentiment encouraging manufacturers to take on extra staff. Meanwhile, the rate of input cost inflation quickened to the sharpest since October 2012 and firms raised their output prices at a solid pace.

The seasonally adjusted Investec PMI posted 55.5 in January, broadly unchanged from the reading of 55.7 in December and thereby signalling a further sharp monthly improvement . Central to the latest improvement in business conditions was a sharp and accelerated increase in new orders at manufacturing firms. The rise in new work was the sixth in as many months and the strongest since July 2015.

New business from abroad also increased sharply. Firms responded to higher new orders by raising production. The rate of expansion ticked up and was the fastest in a year-and-a-half. Forecasts of higher sales volumes in future months supported optimism among companies that output will continue to increase in 2017. Sentiment remained strongly positive as close to 48% of panellists predicted an expansion.

Positive forecasts alongside increases in current production requirements led firms to take on extra staff again in January. The rate of job creation was sharp, though slightly weaker than at the end of 2016. Despite a further marked rise in staffing levels, backlogs of work continued to increase, extending the current sequence of accumulation to four months. That said, the latest rise was much weaker than posted in the previous month.

The rate of input cost inflation accelerated sharply in January and was the fastest since October 2012. Survey respondents mentioned higher commodity prices, the weakness of the euro against the US dollar and higher charges by UK suppliers. Some firms were able to pass on rising costs to clients, resulting in a further solid increase in output prices.

Manufacturers increased their purchasing activity for the fifth consecutive month in January. This caused capacity pressure on suppliers, leading to a further lengthening of delivery times. Despite higher input buying, stocks of purchases continued to fall as inputs were used in the production process. Stocks of finished goods were also depleted, with products delivered to customers to help fulfil orders.

Investec Ireland Chief Economist Philip O’Sullivan said: “The latest Investec Manufacturing PMI Ireland report shows a further sharp monthly improvement in the health of the sector. The headline PMI was little changed at 55.5 in January from the previous month’s 55.7 reading.

“A key highlight within today’s report is the New Orders component, which recorded its fastest pace of growth since July 2015. Panellists reported higher demand from both new and existing clients. Overseas demand was robust, as evidenced by the fifth successive monthly expansion in New Export Orders – interestingly, some respondents indicated higher new orders from the UK, a welcome (if somewhat surprising) outturn given recent currency moves.

“Higher New Orders led to a further accumulation in Backlogs of Work. In response to this, manufacturers added to payrolls (as they have done in each of the past four months). Despite a further expansion in the Quantity of Purchases (albeit at a somewhat slower pace than in the previous month), depletions were recorded in both Stocks of Purchases (for a ninth successive month) and Stocks of Finished Goods (for a third month in a row).

“On the margin side, the rate of input cost inflation accelerated sharply during January to the fastest since October 2012. There were a number of factors behind this, including higher commodity prices, the weakness of the euro against the US dollar and price rises at UK suppliers. Some firms were able to pass on at least a portion of these cost pressures by hiking Output Prices (as they have done for eight successive months now). Nonetheless, the Profits component (a new addition to the Manufacturing PMI report this month) dipped back into negative territory after posting a modest increase in December.

“Another new addition to the PMI this month is the Future Output index. While the rate of optimism implied by this moderated slightly in January, with more than 90% of firms expecting to see output levels either being maintained or increased over the coming year, it is clear that sentiment on the whole remains positive.”

The full report can be read here.