Property Market Grows 8% – Almost Half of Homes Bought With Cash

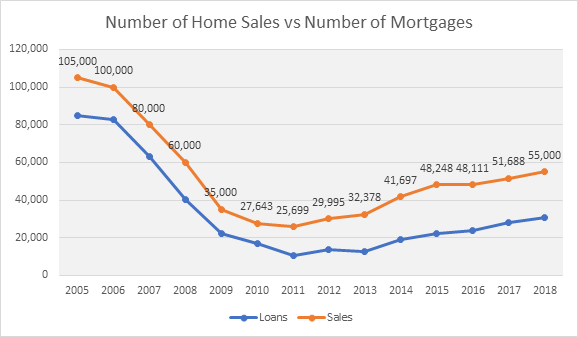

The latest quarterly Consumer Market Monitor (CMM), published by the Marketing Institute of Ireland and UCD Michael Smurfit Graduate Business School, shows slow but steady growth in Ireland’s residential property market, with 55,000 homes purchased in 2018, an increase of just 8% on the previous year. Excluding mortgages from the 2018 figures, there were almost 25,000 homes purchased with cash or savings last year. This represents 45% of all the properties sold, similar to the level of cash purchases made during the recession years, 2009-2013.

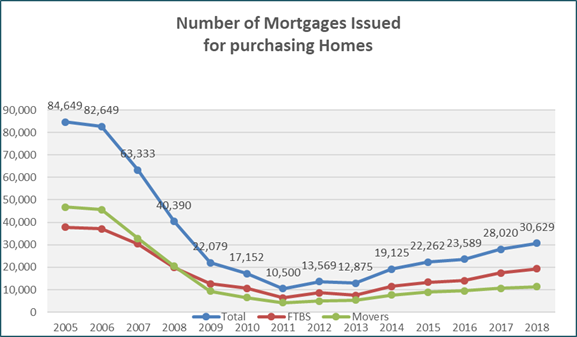

While the residential property market is growing, the number of homes purchased in Ireland last year was approximately half the amount purchased during the height of the last boom in 2005, when 105,000 homes were sold. The Consumer Market Monitor (CMM) also shows that there was an increase of 12% in the number of mortgages issued during 2018, with 30,629 drawn down, but again this is a considerably lower level than during the last boom, with 85,000 mortgages issued in 2005 and similar levels in 2006 and 2007.

While market growth was sluggish, demand remains high for housing in Ireland. The CMM shows that there has been a rapid expansion in the workforce: since 2012 there have been 430,000 new jobs created and the annual rate of new household formation is at approximately 35,000.

Construction has picked up in recent years, with 15,000 new units built in 2017; 18,000 new units built in 2018 and another 20,000 and 23,000 new homes set to come on stream in 2019 and 2020 respectively. However, based on the rate of new household formation, construction levels fall short of the number required to bring housing demand and supply into balance. The CMM shows that there is a need for 350,000 extra housing units to meet demand over the next 10 years. This level of house-building would increase Ireland’s total housing stock by 17.5% to 2.35 million units.

Professor Mary Lambkin, author of the report, said: “The consumer economy is performing well in most areas, but the residential property market is still lagging behind. There were 55,000 homes sold in 2018, an increase of just 8% year-on-year, a rate of growth that has remained consistently low over the past five years. This compares to the boom years of 2005-2007 when over 100,000 homes were sold each year.

“The property market’s sluggish growth does not reflect the large increase in the working population and the rate of new household formation that has occurred over the past five years. While the number of homes for sale has increased to about 23,500, the level of property sales should be about double the current level, approaching the level that the market experienced during the early 2000s, when the workforce was about the same level as it is today.”

Tom Trainor, Chief Executive of the Marketing Institute of Ireland, said: “The outlook for 2019 is largely positive, with fundamental economic conditions remaining strong and likely to continue to drive employment and income growth. The risk of a hard Brexit is weakening consumer confidence, in turn moderating the outlook for spending. But also, the mismatch between property supply and demand means home prices and rents are likely to outpace pay and will hit disposable income.”

Property Sales

The residential property market peaked in 2005 when 105,000 homes were sold and 85,000 mortgages were issued to owner-occupiers. In 2011, it fell to its lowest point when just 25,700 properties were sold and 10,500 mortgages were issued. From that low point, residential property sales crept back up year-on-year, with modest increases each year in the number of properties sold and in the number of mortgages issued to finance them. The number of properties sold reached 42,000 in 2014 while the mortgage number was 19,000 – equal to 45% of sales.

Since 2014, sales have increased by 8% per year, on average. First-time buyers have accounted for over 60% of all sales during this period. Forecasts suggest that sales will increase by a further 5% this year, a modest rate of growth that is at odds with the high level of demand that is driving up rents and purchase prices nationally.

At the low point in the market in 2009, there were 60,000 homes for sale on the property websites – a number that did not vary for about four years. As sales picked up from 2012, the stock of homes available for sale dropped year-on-year, until it reached an all-time low of 20,500 at the end of 2017.

Mortgages & Cash Purchases

There were 30,629 mortgages issued in 2018 for home purchases, compared with more than 80,000 each year during the earlier part of the 2000s. Given that the workforce is back to the same numbers as in those years, it seems reasonable to argue that the number should be at least double what it currently is in a normal market.

In the absence of mortgage finance, almost half of the homes purchased relied on cash and savings, similar to the recession years when mortgage approvals were at an all-time low. In fact, Irish households have increased their savings dramatically in recent years; bank deposits stood at €12.4 billion in 2018, compared to €7.3 billion in 2006.

Property Prices & Affordability

The shortage of supply has been driving prices up with the result that homes are becoming increasingly less affordable. The average home in Ireland costs just over five times the average income at present, which is much less than the nine times income that pertained at the height of the last boom. However, this ratio is considerably higher than the borrowing limit of 3.5 times income imposed by the Central Bank, meaning that many would-be purchasers cannot qualify for a mortgage.

Conclusion

The conclusion that emerges is that the property market is growing cautiously. It may not be fully satisfying the latent demand in the market, but the constraints on lending seem to be working well to prevent excessive borrowing that would drive up prices even more on the limited numbers of homes for sale. As the stock of new homes under construction rolls out into the market, the needs of more buyers can be met in an orderly way.

The upward trend in the property market is expected to continue in 2019, with sales to increase by 5% to 58,000. This will be facilitated by the increasing rate of construction of new homes as well as increasing supply of second-hand properties coming on the market.